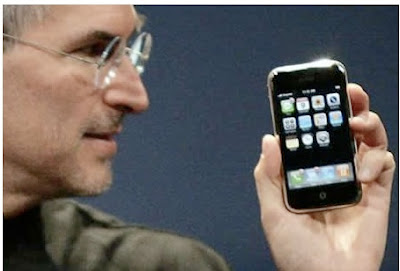

Apple will be selling the new third generation iPhones at a much cheaper rate. $200 less than older versions, if you can imagine that. That's sure to kill future purchases for older models though

But the way Apple now shares its income with carriers has also changed. Whereas historically, carriers get a percentage of the initial purchase and the users continuing payments during the life of the contract, the new scheme lets Apple keep all of the initial sale while carriers will benefit more from the recurring fees of users.

I think this isn't such a bad idea as carriers will be forced to provide more continuous customer support after the sale.

Apple has decided to expand its dealership for operators. Under the former business model, Apple reached exclusive deals that allowed only one operator per country to sell the phone. That strategy, while building up demand, was criticized as cloistering the iPhone from a potential huge audience.

All this will fall into place when the new 3G iPhone goes on sale next month. So watch out for it. It's twice as fast at only half the price -- on sale July 11